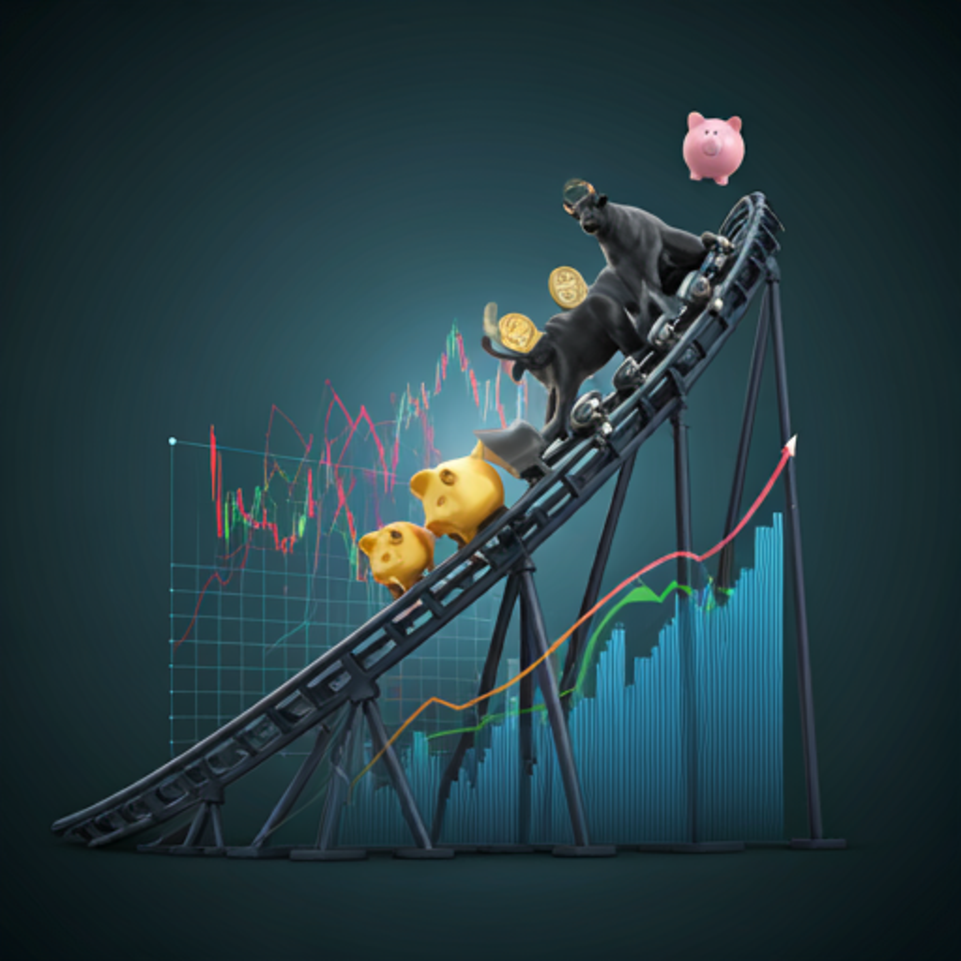

Navigating the Stock Market Rollercoaster: Tips for Investors

What Causes Market Fluctuations?

Market fluctuations are primarily driven by a combination of economic indicators, investor sentiment, and geopolitical events. These factors can create uncertainty, leading to rapid changes in stock prices. Investors often react to news, which can amplify volatility. Understanding these dynamics is crucial for making informed decisions. Knowledge is power in investing. Additionally, market psychology plays a significant role, as fear and greed can lead to irrational behavior. Emotions can cloud judgment. Recognizing these influences helps investors navigate the complexities of the market effectively. Awareness is key to success.

The Impact of Economic Indicators

Economic indicators significantly influence market trends and investor behavior. Key indicators include GDP growth, unemployment rates, and inflation. These metrics provide insights into the overall health of the economy. Understanding them is essential for strategic planning. For instance, rising inflation may prompt central banks to increase interest rates. This can lead to decreased consumer spending. Awareness of these changes is vital. Additionally, investor sentiment often shifts in response to these indicators. Emotions can drive market movements. Recognizing this relationship helps investors make informed decisions. Knowledge is crucial for success.

Investment Strategies for Uncertain Times

Diversification: Spreading Your Risk

Diversification is a critical strategy for managing investment risk. By allocating assets across various sectors and asset classes, an investor can mitigate potential losses. This approach reduces exposure to any single investment’s volatility. It’s a smart move. For example, combining stocks, bonds, and real estate can enhance portfolio stability. A balanced portfolio is essential. Additionally, diversification can improve long-term returns by capturing growth in different markets. Growth opportunities abound. Investors should regularly reassess their asset allocation to maintain optimal diversification. Regular reviews are necessary.

Long-Term vs. Short-Term Investing

Lonv-term investing focuses on building wealth over time through the appreciation of assets. This strategy often involves less frequent trading and a greater tolerance for market fluctuations. Patience is key. In contrast, short-term investing seeks to capitalize on market volatility for quick gains. This approach requires active management and a keen understanding of market trends. Quick decisions are essential. Each strategy has its merits, depending on an investor’s goals and risk tolerance. Understanding personal objectives is crucial.

Technical Analysis: reading material the Market

Key Indicators to Watch

Key indicators in technical analysis include moving averages , relative strength index (RSI), and volume trends. These metrics help investors identify potential entry and exit points. Understanding these indicators is essential for informed trading decisions. Knowledge is power. For instance, moving averages smooth out price data to highlight trends. Trends can reveal market direction. Similarly, RSI indicates overbought or oversold conditions. Awareness of these conditions is crucial. Monitoring volume trends can also signal potential reversals. Volume matters in trading.

Chart Patterns and Their Significance

Chart patterns are essential tools in technical analysis, providing insights into potential future price movements. Recognizing patterns like head and shoulders or double tops can indicate market reversals. Patterns reveal trader sentiment. For example, a bullish flag suggests continuation of an upward trend. Trends can guide investment decisions. Additionally, understanding volume in conjunction with patterns enhances their reliability. Volume confirms price movements. Investors should study these patterns to improve their trading strategies.

Fundamental Analysis: The Bigger Picture

Evaluating Company Performance

Evaluating company performance involves analyzing key financial metrics such as revenue growth, profit margins, and return on equity. These indicators provide insights into a company’s operational efficiency. Understanding these metrics is essential. For instance, consistent revenue growth suggests a strong market position. Growth indicates potential. Additionally, examining cash flow statements reveals a company’s liquidity and financial health. Cash flow matters for sustainability. Investors should also consider industry benchmarks to assess relative performance. Comparisons provide context. This comprehensive analysis aids in making informed investment decisions.

Understanding Market Sentiment

Understanding market sentiment is crucial for investors. It reflects the overall attitude of investors toward a particular security or market. Sentiment can drive price movements. For example, bullish sentiment often leads to rising prices. Rising prices indicate optimism. Conversely, bearish sentiment can result in declines. Declines signal caution. Tools like surveys and social media analysis can gauge sentiment effectively. Awareness is key in trading. Monitoring sentiment helps investors make informed decisions. Knowledge is essential for success.

Risk Management Techniques

Setting Stop-Loss Orders

Setting stop-loss orders is a vital risk management technique for investors. These orders automatically sell a security when it reaches a predetermined price. This helps limit potential losses in volatile markets. Losses can escalate quickly. By wstablishing stop-loss levels, investors can protect their capital. Protection is essential for long-term success. Additionally, stop-loss orders can help maintain emotional discipline during trading. Discipline is crucial in investing. Investors should regularly review and adjust their stop-loss levels based on market conditions. Regular adjustments are necessary for effectiveness.

Position Sizing and Capital Allocation

Position sizing and capital allocation are critical components of effective risk management. By determining the appropriate amount to invest in each position, investors can mitigate potential losses. This approach helps maintain a balanced portfolio. Balance is essential for stability. Additionally, capital allocation strategies ensure that funds are distributed according to risk tolerance and market conditions. Awareness of risk is crucial. Investors should regularly reassess their position sizes based on performance and market volatility. Regular reviews enhance decision-making.

The Role of Emotions in Investing

Recognizing Emotional Traps

Recognizing emotional traps is essential for successful investing. Emotions like fear and greed can cloud judgment and lead to poor decisions. Poor decisions can result in significant losses. For instance, fear may cause an investor to sell at a loss during market downturns. Selling can exacerbate losses. Conversely, greed can lead to overexposure in high-risk assets. Overexposure increases vulnerability. Investors should develop strategies to manage their emotions effectively. Awareness is key to maintaining discipline.

Strategies to Maintain Discipline

Strategies to maintain discipline are crucial for successful investing. Establishing a clear plan helps investors stick to their goals. A plan provides direction and focus. Additionally, setting specific entry and exit points can reduce emotional decision-making. Clear points guide actions. Regularly reviewing performance also reinforces discipline. Reviews help identify patterns and mistakes. Furthermore, utilizing automated trading tools can minimize emotional interference. Automation reduces stress inwards trading. Investors should prioritize emotional awareness to enhance their decision-making process. Awareness is essential for success.

Leveraging Technology in Investing

Using Trading Platforms and Tools

Using trading platforms and tools enhances an investor’s ability to make informed decisions . These platforms provide real-time data and analytics, which are crucial for effective trading. Real-time data is essential for accuracy. Additionally, many platforms offer advanced charting tools that help identify trends and patterns. Trends can guide investment strategies. Furthermore, automated trading features allow investors to execute trades based on predefined criteria. Automation reduces emotional decision-making. Investors should explore various tools to find those that best suit their needs. Finding the right tools is vital.

Staying Informed with Market News

Staying informed with market news is essential for effective investing. Access to timely information allows investors to make informed decisions. Timely information is crucial for success. Utilizing financial news apps and websites can streamline this process. Apps provide quick updates. Additionally, subscribing to newsletters can deliver curated content directly to an investor’s inbox. Curated content saves time. Engaging with financial podcasts and webinars also enhances knowledge. Regularly consuming diverse sources of information helps investors stay ahead of market trends. Staying ahead is vital for growth.